Summary

- Over 10% of Bitcoin’s blockchain network is run by Core Scientific. The ascent of Core Scientific marks the maturation and institutionalization of Bitcoin.

- Core Scientific could exceed $700M in EBITDA for FY22. It is currently valued at $2.7B despite being larger than Marathon Digital, Riot Blockchain, and Stronghold Digital Mining combined.

- Questionable allegations from a short seller have created an even more attractive entry, with 10M shares sold short (4x-10x daily volume) at a time when Bitcoin is rallying rapidly.

- Bitcoin mining has created a robust foundation that we anticipate will anchor the cryptocurrency ecosystem, with Core Scientific poised to provide industry leadership.

- Core Scientific has attracted an impressive list of talent from Microsoft, Wall Street, and Silicon Valley. It went public with backing from BlackRock.

Introduction: Bitcoin’s Mining King

It might come to you as a surprise that the largest Bitcoin mining operation is relatively unknown in the public markets, making its debut in January without much fanfare. As an early venture investor in the company, it has been equally surprising to see how fast this business has grown, with single project sites larger than the entire company was just a few years ago.

But it was Core Scientific’s stealthy approach that has enabled the company to become ~12% of Bitcoin’s hashrate, meaning that Core Scientific runs over 10% of Bitcoin’s network. Excluding ‘layer-2’ applications, approximately one in ten Bitcoin transactions (transactions that occur directly on the blockchain) is processed by Core Scientific.

What is Bitcoin mining? Why does it matter?

Bitcoin mining is the process of running specialized computers to operate Bitcoin’s network protocol, referred to as the blockchain. This system has enabled Bitcoin to become the most secure network in the world, and the best performing asset of the last decade. Billions of dollars invested in Bitcoin’s physical infrastructure has created a network insurmountable to attack in all but the most exotic scenarios. Its energy use is sometimes controversial, but its stability is universally acknowledged (Note that Core Scientific is 100% net carbon-neutral).

An early Bitcoin mining rig vs. a state-of-the-art industrial Bitcoin mining facility operated by Core Scientific (PaperCrush/ Core Scientific )

In the beginning, Bitcoin’s blockchain network was run on (or ‘Bitcoin was mined’ on) home computers with processors no more powerful than the device you are using to read this article. Over a decade later, Bitcoin’s simplicity and design elegance has enabled mining to scale into a massive institutionalized industry that spans the globe. Miners today use not only specialized mining machines, but those machines have their own specialized chips designed specifically for the purpose of running Bitcoin’s encryption algorithms.

The blockchain that Core Scientific and its peers support is a foundational, high-security layer that other companies and projects have built on top of. Examples of this include exchanges, such as Coinbase (COIN), and the Bitcoin Lighting Network, which has allowed El Salvador to adopt Bitcoin for inexpensive everyday use.

I think that it’s sort of similar to the original kind of protocol evolution and growth on the internet. You know–That there will be different protocols for VoIP, video streaming, web browsing, email , and so forth… It’s difficult to have a single protocol that that’s optimal for everything.

…

That’s actually quite sort of standard, or normal, for networks… …They’re all operating in layers in in their network architecture. And that’s considered, in engineering terms, a good way to do it because you want the base technology to be robust and to not have fundamental issues arising late. You want it to be very stable and secure.

-Adam Back, Blockstream CEO & Bitcoin pioneer

The HTTP protocol allowed the internet to supersede other networks and protocols such as Usenet, Minitel, SABRE, Telenet, Tymnet, Free-Net, Fido, IBM (IBM) SNA, RelayNet, among many others. There were once other protocols and networks (each with distinct advantages) that competed with “the internet” and the many applications that have been built on top of it.

This context puts the evolution of Bitcoin into perspective; We are still in the early stages. Cross-blockchain integration, the next frontier, will likely keep Bitcoin at the center of the crypto ecosystem over the long run. Bitcoin offers unparcelled stability and security. Mining makes this possible.

Though we have investments in other cryptocurrencies, it is on a limited basis precisely for this reason. Experimental projects are likely to be integrated back into Bitcoin, either through bridges that create compatibility or by appropriation of breakthrough innovations. Cryptocurrency is the consummation of open-source philosophy.

Overview of Core Scientific

Core Scientific has grown to play an instrumental role in Bitcoin’s blockchain/network. It is one of the largest Bitcoin mining operations in the world, and the largest in the Western Hemisphere. It has 457MW of operational power, enough to power a small city. This is expected to scale to 1.2GW+ by the end of FY 2022. Between hosting and self-mining, over 10% of Bitcoin’s blockchain is running in Core Scientific facilities.

The company snowballed out of a group of friends who began mining Bitcoin as a hobby in its early days. This mix between an amateur project and an experimental business was ignited when former Microsoft COO Kevin Turner took the helm. After being asked if he was interested in investing, Turner reportedly replied: “How about I be CEO?”

Core Scientific’s first megasite, located in North Carolina. (Core Scientific)

When the stealthy company planned its first large facility, a 100MW expansion in North Carolina, this was seen as audacious. The anticipation was that it would take years to fill. At that time, Marathon Digital (MARA) was a struggling patent troll with a little over $500,000 in revenue for the year. ‘Riot Blockchain’ (RIOT) had only narrowly escaped its fate as a failed biotech company called Bioptix. Core Scientific has since struck hosting deals larger than the company was at that time. In October, the Core Scientific announced that it will build a single facility with 300MW of capacity.

Turner stepped down as CEO, given his aversion to the intense spotlight of a publicly traded company. He was replaced by Michael Levitt, a veteran of the finance industry. Levitt co-founded the Financial Sponsors Group at Morgan Stanley, one of the bank’s largest operations today. He went on to become the Vice Chairman of Apollo Global Management ($472B in AUM) and then CEO of Kane Andersen Advisors ($41B in AUM).

The pathway to an IPO was complicated by the fact that investment bankers were still largely apprehensive of cryptocurrencies at the time the company discussed going public. The US government was not yet implicitly supporting their development. Recall that even Coinbase had to do a direct listing.

For this reason, the company chose to go public through a BlackRock-backed SPAC merger, with Evercore and Barclays acting as advisors. Unlike many SPAC deals, the Core Scientific/XPDI merger was handled in a responsible way. The valuation left a lot of room for new investors to make money, and incentive for existing investors to stick around.

Inside one of Core Scientific’s massive facilities, the vascular organs of the Bitcoin blockchain. (Core Scientific)

Nevertheless, the company could not escape the cynicism that all SPAC deals consist of former investment banking stars taking advantage of inexperienced but enthusiastic retail investors, right before management teams dump all of their shares. The company’s stock has fallen as much as 42% since February. We’ve been buying more.

This was partly due to a highly bearish report by an anonymous short seller, which included many statements that we see as false and/or misleading (which is probably why it isn’t on Seeking Alpha). We will discuss this after an analysis of the financials.

Financials: EBITDA could exceed $750M

In early March, Core Scientific gave preliminary results for FY 2021. The company gives a revenue range because the final numbers will depend on the minutiae of revenue recognition in relation to the price of Bitcoin.

| Preliminary Financial Results | Full Year 2021 |

| Total Revenue | $515 to $545 million |

| Net Income | $50 to $60 million |

| Adjusted EBITDA | $225 to $235 million |

| Total Hashrate (EH/s) | 13.5 EH/s |

| Operating Megawatts (“MW”) | 457 MW |

| Operating Guidance | Full Year 2022 |

| Total Hashrate (EH/s) | 40 to 42 EH/s |

| Operating Gigawatts (“GW”) | 1.2 to 1.3 GW |

Based on this guidance, Core Scientific may be closing in on 20% of the Bitcoin network by the end of 2022, assuming a 240 TH/s hash rate at the end of the year.

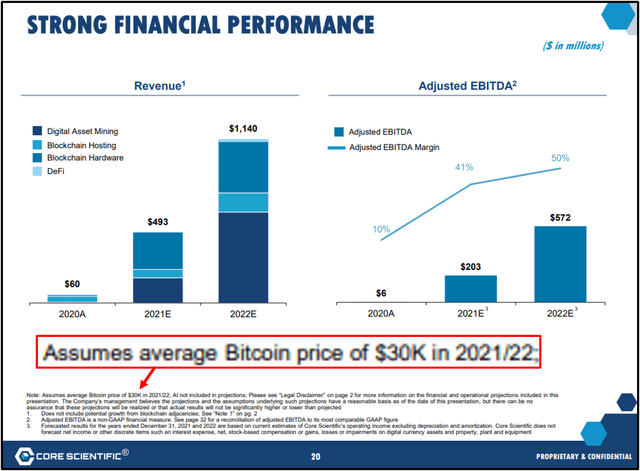

Slide 20 from Core Scientific’s July 2021 investor presentation. So far, Core Scientific’s projections have overestimated mining difficulty and grossly underestimated Bitcoin’s price. (Core Scientific)

But Core Scientific’s projections are notably conservative. The average hashrate, the measure of difficulty of mining Bitcoin, has been well below the 240 TH/s that the company has used for its projections. In the last 50 days, it has averaged 200 TH/s. Core Scientific also assumed a Bitcoin price of $30,000. At the time of writing, it is slightly over $47,000.

Based on these factors, we anticipate that the company will do in excess of $700M in EBITDA in FY 2022. With a 10x FW EBITDA multiple, combined with $148B in cash and over 7,300 Bitcoins (worth $346M), we believe the company is worth $7.5B at the low end. This back-of-the-napkin-calculation does not even consider massive facilities that are the industry standard, a company fleet of over 80,000 miners, proprietary management software developed by a team of Microsoft alumni, and over 70 patents and patent applications.

A 20x FW EBITDA multiple would seem more appropriate for a business that is growing in excess of 100% a year. This would value the business closer to $14B, and it would still look cheap on a comps basis. Based on Friday’s close, this would mean upside of over 4x.

Competition or Integration?

But there is even more value waiting to be unlocked from the maturation of Bitcoin as an industry. As argued, the Bitcoin “main chain” where blockchain transactions are processed and finalized is merely the first layer in a nascent revolution that will create a new financial, business, and economic regime.

Today’s experimental DAOs might be tomorrow’s big tech. CBDC’s will revolutionize central banking. NFT’s will transforming video games. Sophisticated smart contracts could modernize our financial infrastructure.

Though the cryptocurrency industry is a colorful and lively kaleidoscope of innovation, it is ultimately one that revolves around Bitcoin. The prohibitive cost and slow execution of processing smart contracts on “main chains”, blockchain base layers, has been the bane of developers looking to create decentralized applications.

Where speed meets inexpensive cost, instability has been the result. Solana is impressive technology. It has also been victim to several attacks and hacks. No one is really sure if ‘Ethereum 2.0’ will be stable over time. All of these innovative upstarts may wake one day to find their advantages nil compared to an advanced application layer build on top Bitcoin’s robust physical infrastructure; The same way that the ‘Bitcoin killers’ of five years ago found their comparative advantages largely worthless.

The network failing is not an option for Bitcoin. So I think that’s the analogy of modifying the flight control software of a super jumbo in flight… Bitcoin is continuously operating so changes to it have to be very well tested.

And then of course, there’s a lot of very rapid innovation in applications built on top of lightning, in a lightning protocol, in a liquid protocol, in the layer twos, and in the application layer.

So yeah… …I think some of the other platforms in the in the wider crypto space have tokens. And so, they’re more focused on advertising the token. And so, they tend to be very heavy on marketing.

Bitcoin doesn’t have a marketing department. It just has lots of different individuals that own it, and essentially nobody really marketing it to the world, right? It’s just marketed by organic adoption so it tends to be kind of low-key messaging, I guess. Right?

And the people building on it are more interested in building lasting value because they don’t have a token that they’re trying to like rush to market or sell or something.

-Adam Back, Blockstream CEO & Bitcoin pioneer

The future value of Core Scientific will be ultimately determined by the value and success of Bitcoin. As the industry leader, Core Scientific is acutely aware of the responsibility it has:

In summary, the thought that I’d like to leave you with is that we are a technology company, working to develop infrastructure and other financial products and services, to help, develop, build-out, power, and facilitate this evolving financial system that we are all experiencing, using, and living with every day.

This is a dynamic period for markets, and it’s a dynamic period in terms of development of our financial systems. We believe in decentralized finance. We believe that digital assets will continue to be an important and growing part of the world of decentralized finance.

And we’re building a business to help ensure that happens, and to facilitate that in the smoothest, most positive way possible. We take very seriously our commitment to be responsible participants in that system.

-Mike Levitt, CEO of Core Scientific (3/24/22)

Tucked inside this mining behemoth is a forward-thinking R&D assemblage, that is working on the development of products and services built on blockchain technology (presumably, Bitcoin). Core Scientific acquired RADAR, a developer of software for decentralized finance. RADAR developed software that allowed users to trade cryptocurrency without the need for a centralized exchange, such as Coinbase (COIN). Core Scientific also has an artificial intelligence division, with a partner ecosystem that includes AWS and Nvidia.

Bitcoin’s ‘Taproot’ update was successfully completed in November 2021. This made Bitcoin more programmable, allowing more support for smart contracts. More advanced Layer-2 applications will expand Bitcoin’s use case. Progress in sidechain technology will deepen Bitcoin integration with the rest of the ecosystem.

Short seller attack as a catalyst

It’s not hard to see why a Bitcoin miner might attract a short seller. Some of Core Scientific’s competitors have failed to draw a thorough distinction between nameplate capacity and actual operating infrastructure. Others have given wildly unrealistic guidance on expansion plans. TeraWulf (WULF) went public at a valuation over $1B without having mined a single Bitcoin.

Yet “Culper Research”, an anonymous short seller, chose Core Scientific as the target of a highly bearish publication. With limited trading volumes, the stock fell 30% over the course of five trading sessions. The company has said that the limited trading volumes are the reason they ended the lock up early, to try to deepen the liquidity enough to allow institutional investors to build positions. Even with most of the shares unlocked, 4x-10x the daily volume is sold short (over 10M shares).

The report levied the bizarre accusation that Core Scientific’s breakeven cost on Bitcoins mined is $41,700. It then accused Core Scientific using unrealistic projections to ‘set insiders up to dump billions of stock’, while totally ignoring the highly conservative assumptions clearly stated in Core Scientific’s footnotes.

It attempted to link a Core Scientific to an obscure vendor known as “BitFuFu”, when in reality Core Scientific uses, supplies, and hosts Bitmain hardware almost exclusively. The report also suggested that Core Scientific “insiders” flipped a mining offshoot, Blockcap, at a self-serving valuation. Somehow, “Culper Research” obtained intimate financial details related to Blockcap without mentioning that Blockcap was leveraged 7x.

Perhaps most egregiously, it focused heavily on one of the early co-founders what he was doing in the 1990’s, as if this was somehow relevant. Perhaps unsurprisingly, the report failed to mention that the company was mostly built by the former COO of Microsoft, and is currently headed by the former Vice Chairman of a nearly $500B private equity firm.

We find these allegations to be delusional at best, given that Culper Research made blatantly ignored the company’s own footnotes on assumptions and projections, in favor of painting the insiders of the company with malicious intent. With Bitcoin rising 25% in 2 weeks, and still over 10M shares sold short, this seems like an attractive entry point. Core Scientific did not dignify Culper Research with a response.

Risks

The “report” from Culper Research may have been creative in its interpretation of reality, but that’s not to say that Core Scientific does not have material risks. The fate of both Bitcoin and Core Scientific are intimately linked.

However, other risks are often misunderstood. Rising energy costs hurt energy margins, but this is offset by the fact that Core Scientific has extensive power contracts and does not purchase power at market rates. These contracts are negotiated well before delivery.

Regulatory risk is also an important consideration. While Core Scientific is 100% net carbon-neutral, the energy use of Bitcoin mining has been the target of scrutiny by regulators. However, outside the domain of energy use, we think the regulatory environment for cryptocurrency is favorable. We interpret regulator attitudes as constructive, something written about recently.

Finally, there is the relationship between Bitcoin’s network difficulty (hashrate) and revenues for Core Scientific. Higher difficulty (higher hashrate) means mining is less profitable, as Bitcoin’s blockchain automatically adjusts the difficulty level to regulate the speed of mining. Rising hashrate is usually offset by higher prices. The reason for this dynamic is that when Bitcoin rises, less profitable operators ‘jump in’ when they reach profitability.

Conclusion

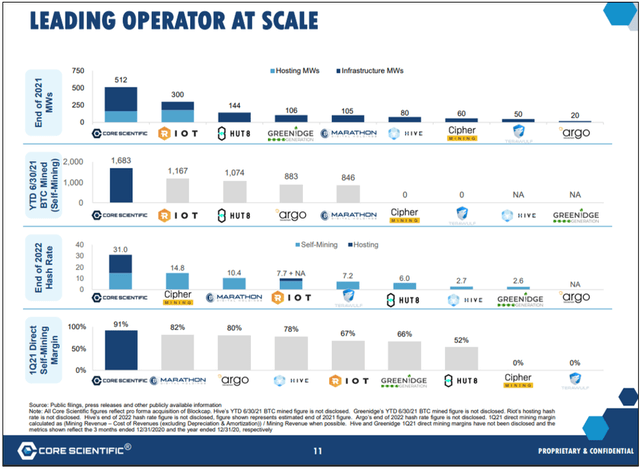

Slide 11 from Core Scientific’s July 2021 presentation. Note that Core Scientific has recently updated these projections, revising them upward. (Core Scientific)

So how did Core Scientific become the ‘King of Bitcoin’? Some friends with an interest in cryptocurrency had their startup supercharged by the former COO of Microsoft, before he turned it over to a Wall Street veteran. Along with them, a team dedicated to advancing blockchain and decentralized technology.

Core Scientific and Bitcoin have heavily intertwined fates. By representing over 10% of Bitcoin’s hashrate, we estimate that Core Scientific mines approximately 1 in 10 Bitcoins mined on any given day between hosting and the company’s proprietary operations. Based on Core Scientific’s own projections, it could mine as many as 1 in 5 Bitcoins mined by year end, depending on the network difficulty.

But to have this kind of scale this early in a blossoming industry? With this incredible of a team? As long-term investors (at this point, bona fide HODLRs), we are holding out for something even better.